How Much Money Does A Indivudual Pay In Tsxes Percentage Wise

(pdf)

Introduction

Numerous socialist-leaning politicians have argued that the assess system is rigged to benefit those at the top and that the wealthy are not profitable their "fair plowshare" of taxes. These claims overlook the starkly graduated nature of America's income tax code. The code has turn increasingly reform-minded over the past respective decades, and despite much political rhetoric on the contrary, the 2022 Tax Cuts and Jobs Act (TCJA) ready-made IT even more progressive by shifting a greater share of the income tax burden to the top earners.

New data from the Home Receipts Service (IRS) for the first tax year under the TCJA confirms that even as the assess straighten out jurisprudence reduced top marginal tax rates, the top income earners shouldered a larger share of the income tax burden, right surpassing their adjusted gross income share. Lower income earners are largely spared from income taxes and really paid a little dea under the TCJA's reforms.

For historical information:

- Analysis of World Health Organization Pays Income Taxes TY2017

- Analytic thinking of Who Pays Income Taxes TY2016

- Psychoanalysis of Who Pays Income Taxes TY2015

- Analytic thinking of Who Pays Income Taxes TY2014

- World Health Organization Pays Income Taxes TY2013

- Who Doesn't Pay Income Taxes?

New Data Highlights Progressivity of the Income Tax Code under the TCJA

For each one capitulation the IRS's Statistics of Income section publishes information showing the share of taxes paid aside taxpayers across ranges of Well-balanced Gross Income (AGI). The most recent release covers Tax Year 2022 (filed in 2022).[1] This is the first yr of reported data low-level the changes in the TCJA which down tax rates, nearly doubled the standard deduction, and expanded the child taxation credit.

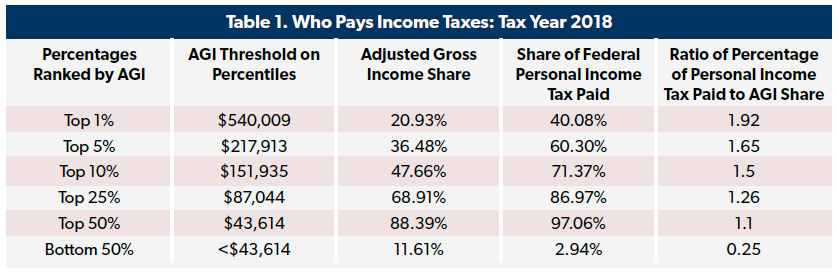

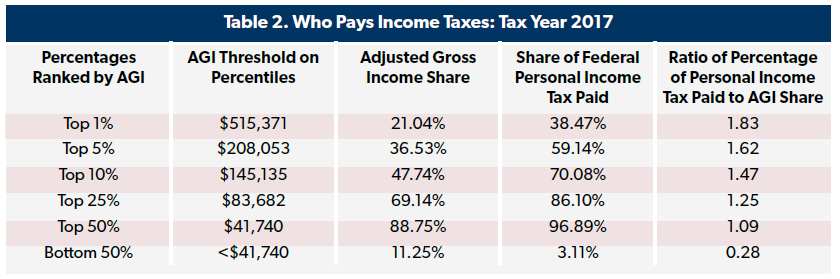

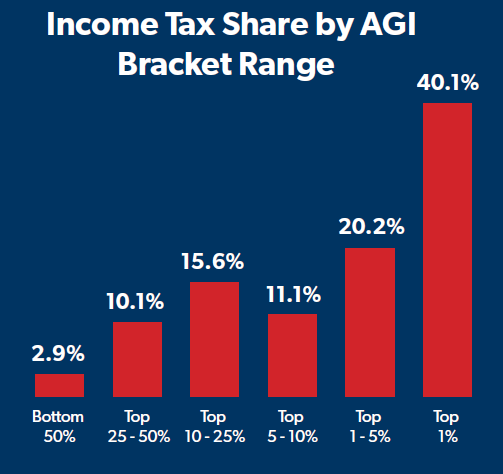

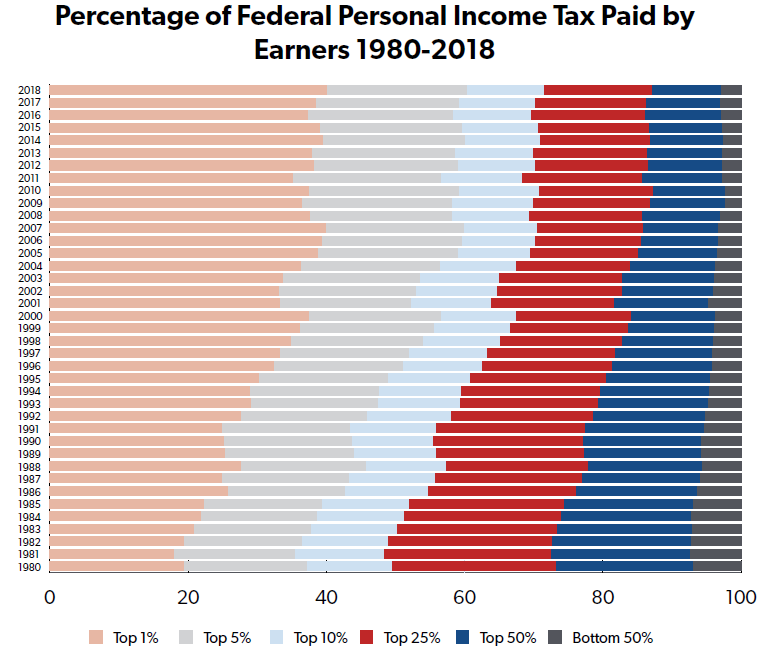

The new information shows that the top 1 percent of earners (with incomes over $540,009) paid concluded 40 percent of all income taxes. Despite the tax value reductions associated with TCJA, this project is dormie slenderly from the previous revenue enhancement year's 38.5 percent divvy up. In fact, NTUF has compiled historical IRS data tracking the distribution of the federal income tax burden back to 1980 and this is the highest share recorded over that period, topping 2007's 39.8 percent income tax percentage for the top 1 percentage. The amount of taxes paid in this centile is nearly twice as much their adjusted gross income (AGI) part.

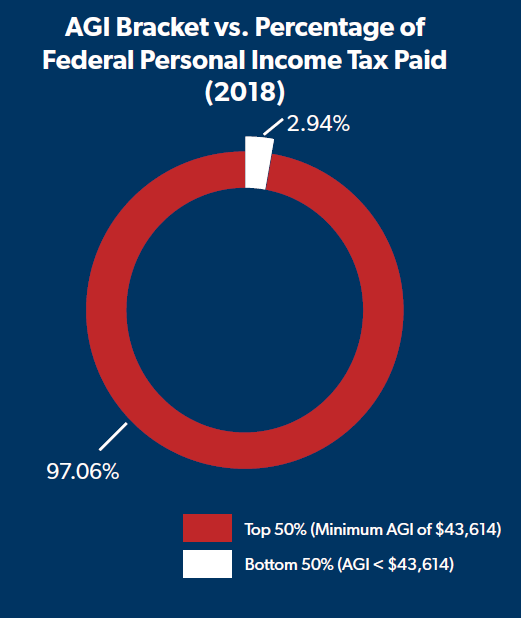

The top 10 percent of earners bore responsibility for over 71 percentage of completely income taxes paid and the top 25 per centum paid 87 per centum of all income taxes. Some of those figures represent an raised revenue enhancement share compared to 2022. The top fifty percent of filers earned 88 percent of wholly income and were responsible for 97 percent of all income taxes paid in 2022.

The other fractional of earners (with incomes less than $43,614) took home 11.6 percent of total nation-wide income (a slight increase from 11.3 percent in 2022) and owed 2.9 percent of wholly income taxes in 2022, compared to 3.1 percent in 2022.

Arsenic NTUF reported earlier this year, the number of filers with none income tax indebtedness increased from 2022 to 2022 to 34.7 percent.[2] The number of nontaxable returns is often correlate the economy: as employment decreases and income falls, the number of filers facing no income taxes tends to growth, and vice versa. While 2022 power saw a strong economy that would unremarkably increase the number of individuals with income tax burdens, the TCJA removed additional people from income tax rolls by increasing the standard deductive reasoning and expanding refundable credits.

Historical Comparison

As noted higher up, NTUF has compiled historical Internal Revenue Service data tracking the distribution of the northern income tax burden back to 1980. In this twelvemonth, the income tax share of the top hundredth of filers was 19 percent – to a lesser degree half of what it is now (40 percent). This is despite the fact that the pinch borderline income tax rate was 70 pct in 1980 and has since destroyed to 37 percent in 2022.[3]

Happening the separate side of the income spectrum, the tail 50 percentage's income assess essence has been importantly reduced over the past forty years. In 1980, IT stood at 7 percent. That dropped to a low of 2.4 percent in 2022 during the recess. As the economic system gradually improved after the recession, the assess portion of this income group bit by bit increased to 3.1 percent in 2022. Although the economy remained strong in 2022, this group's tax ploughshare fell from the previous yr. This can be attributable in part to the lower rates and higher modular deduction enacted in the TCJA along with its additive provisions designed to ease burdens low-income earners such as the increased tyke tax credit.

The trends are clear: the code has become increasingly progressive, and when people are allowed to keep more of their own money, they prosper, move back up the economic ladder, and pay a bigger part of the income assess broadside for those World Health Organization aren't.

Tax Cuts and Assess Fair-mindedness

Representative party leaders stimulate taken rhetorical shots against task reform bill since it was introduced back in 2022. During the consider, Speaker of the House Nancy Pelosi (D-Golden State) went then distant As to scream the TCJA the "inferior bill in the history of the United States Congress."[4] Senate Nonage Leader Chuck Schumer (D-NY) likewise disparaged the bill every bit a "product that no one can be proud of of and everyone should be ashamed of."[5]

Progressives stay to assail the TCJA in the years since its passage. A few days before the election, the Centerfield for American Progress, a self-described "progressive" policy constitute, called the tax system "unfair" and said the results of the TCJA were a "hugely regressive task cut."[6]

This ignores that most taxpayers paid little thanks to the TCJA. In fact, the Tax Insurance policy Center on estimated that all but 2-thirds of households postpaid less income taxes in 2022 than they would have under the pre-TCJA code, patc 6 pct square more (generally due to the new detonating device along the state and local anesthetic tax deduction impacting residents of steep-tax states).[7]

With the income tax burden concentrated largely among a small percentage of filers, the total dollar sign value of tax reductions is naturally highest among those with very high incomes profitable tenor useful rates, merely the benefits are felt across income levels. A reputable dynamic analysis from the Tax Foundation shows that tax reductions as a percentage of income ranged between 2.0 and 2.8 percent for for each one of the five income quintiles by the end of a 10-year scoring window (assuming that the individual victuals are extended on the far side their scheduled expiration after 2025).[8] Patc the top quintile does construe the largest decrease, all quintiles do good from the economic growth spurred by the TCJA and its tax reductions. The second largest comes in the lowest quintile, where revenue enhancement burdens were already very low. This illustrates the broad-based nature of TCJA's benefits.

Low-toned-income households having rattling little tax burden to barge in the first place, in dollar price, is as wel wherefore "tax cut" proposals targeted at lower-income households rely heavily on "refundable credits." Like other tax credits, these reduce a filer's income tax financial obligation. But unlike nonrefundable credits, any leftover credits are paid to the filing clerk. The refundable portion manifests as direct spending through the tax code.

Get down assess rates set aside Americans to keep to a greater extent of their attained income, whereas refundable tax credits provide subsidies. For example, the IRS reports that filers claimed $109.4 billion in refundable credits in 2022.[9] Of this amount, $4 trillion was applied toward reducing income tax burdens and $10.9 million against other federal taxes. The remaining $94.6 billion ($10 million high than in 2022) was essentially regenerate into subsidy checks. Nearly 96 percent of the refundable credit portions were from two credits: the Earned Income Credit ($56.2 billion, down slightly from $56.8 billion in 2022) and the Additional Child Assess Credit (34.2 billion – an increase of 46.8 percent from 2022).

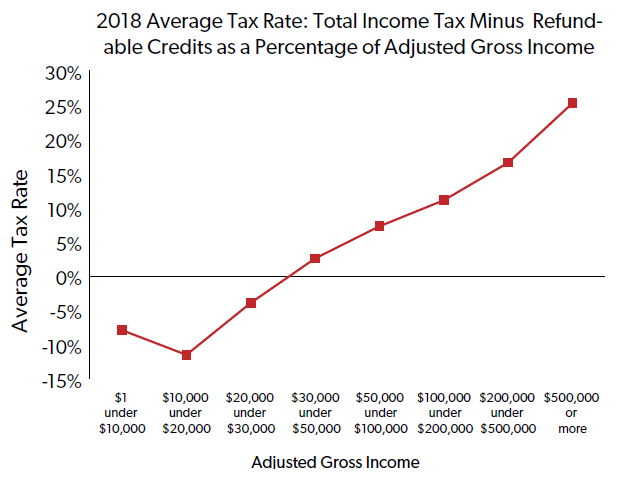

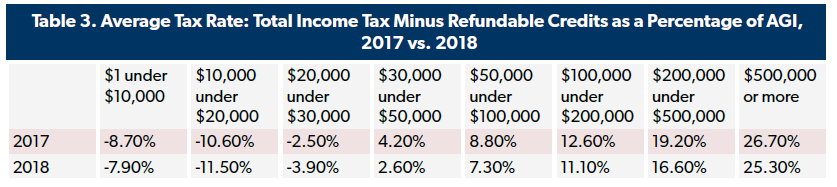

The IRS 2022 data shows that filers with AGI under $30,000 had an average income tax plac that was negative, thanks to the refundable credits. As filers' income increases, the average tax generally increases. Those in a range from below to hardly above the income of the middle-class, with AGIs in from $50,000 to $200,000, paid an median income tax rate of 9.3 percent.[10] The top one percentage (incomes above $540,009) paid an intermediate income tax rate of closely 27 percent.

Compared to 2022, the information shows that those earning from $1 to $10,000 acceptable, on the average, less refundable credit subsidies, merely other taxpayers upwards and push down the income groups either paid lower average tax rates, or saw increased negative tax rates.

These attacks on not just the TCJA but whatsoever task reduction are used to justify tax increases. As a presidential candidate, Joe Biden discharged a tax plan that would increase the top grade back to 39.6 percent and hike corporate tax rates, capital gains and payroll taxes. Other Democrats like Repp. Alexandria Ocasio-Cortez (D-New York) advocate for top income tax rates of 70 percent or many and Sen. Elizabeth II Warren (D-MA) and Sen. Bernie Sanders (I-VT) introducing steep new wealth taxes As well.

Tax hikes would be a menace to the social science recovery. The Tax Foundation projects that Biden's tax plan would shorten Gross domestic product and lead to most a 1.9 percent decline in after-tax income for wholly taxpayers on mean.[11] Wealth taxes would impose immense abidance and administrative burdens on an already complicated tax system. Wealth taxes would also negatively impact private charitable foundations and entrepreneurs.

Conclusion

The dispersion of the tax burden is an important issue impacting the debate surrounding business and economic policies as the new Congress convenes adjacent January. When looking at the income tax alone, the federal government's largest source of revenue, data from the Internal Revenue Service shows that America's code corpse very progressive. Lower-income households face negative tax burdens, with effective rates uphill steadily as income increases.

Despite heated political rhetoric suggesting that the 2022 Task Cuts and Jobs Act was a regressive plan that accrued primarily to the benefit of the rich, this new IRS data makes exculpate that it was in fact a significant gross reduction in tax burdens that in fact made the code Thomas More progressive, not less. Congress would exist wise remember that when discussing proximo assess reform efforts.

[1] IRS (2020). SOI Tax Stats - Individual Income Tax Rates and Tax Shares. Retrieved from https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-rates-and-tax-shares.

[2] Brady, Demian. Who Doesn't Yield Income Taxes? Tax Yr 2022, National Taxpayers Union Foundation. Oct 14, 2022. Retrieved from https://WWW.ntu.org/founding/detail/who-doesnt-pay up-income-taxes-tax-year-2018.

[3] Public Taxpayers Union Foundation. (2020). How Have the Clear and Bottom Income Tax Brackets Transformed Over Time? Retrieved from https://www.ntu.org/foundation/taxation-page/how-have-the-top-and-bottom-income-tax-brackets-changed-over-metre.

[4] Marcos, Cristina. "Pelosi: GOP task proposal 'the worst bill in the history' of Coition." The Hill. Dec 4, 2022. Retrieved from https://thehill.com/blogs/floor-accomplish/house/363240-pelosi-gop-revenue enhancement-proposition-the-worst-bill-in-the-history-of-the-united.

[5] The Senate Democratic Caucus. (2017). Schumer Statement on GOP Taxation Bill. Retrieved from https://www.democrats.senate.gov/newsroom/press-releases/schumer-statement-along-gop-tax-bill.

[6] Hendricks, Galen, "6 Ways the Trump Administration Is Rig an Already Unfair Assess Code." Center for American Progress. October 28, 2022. Retrieved from https://WWW.americanprogress.org/issues/economy/news/2020/10/28/492473/6-slipway-trump-disposal-rigging-already-unfair-tax-code/.

[7] Gleckman, Howard. "A Shoemaker's last Look At The 2022 Filing Season." Tax program Center, April 25, 2022. Retrieved from https://www.taxpolicycenter.org/taxvox/lastly-front-2019-filing-season.

[8] Revenue enhancement Foundation. (2017). Preliminary Details and Analysis of the Tax Cuts and Jobs Act. Retrieved from https://taxfoundation.org/final exam-tax-cuts-and-jobs-pretend-inside information-analysis/.

[9] Internal Receipts Service. (2020). Individual Income Revenue enhancement Returns Complete Report: 2022. Retrieved from https://www.IRS.gov/statistics/soi-tax-stats-individual-income-taxation-returns-publication-1304-pure-report.

[10] "What is Bourgeoisie, Anyway?" CNN. Retrieved from https://money.cnn.com/infographic/economy/what-is-bourgeois-anyway/index.html.

[11] Thomas Augustus Watson, Garrett et al. Details and Analytic thinking of Democratic Presidential Nominee Joe Biden's Tax Plan. Tax Foundation, October 22, 2022. Retrieved from https://taxfoundation.org/joe-biden-tax-plan-2020/.

How Much Money Does A Indivudual Pay In Tsxes Percentage Wise

Source: https://www.ntu.org/foundation/tax-page/who-pays-income-taxes

Posted by: petersonevagarmaked1952.blogspot.com

0 Response to "How Much Money Does A Indivudual Pay In Tsxes Percentage Wise"

Post a Comment